What an amazing month we’ve had! So much has happened in the last week and a lot of people are confused by what it all means for banks. In this post we try to explain a few of the recent events in plain English without getting lost in technical jargon or detail.

Why Are Banks Falling More Than The Market?

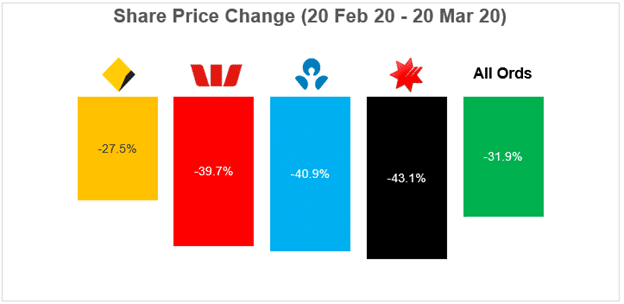

Below shows that 3 of the 4 major Australian banks share prices have fallen ~10% more than the market.

Interestingly, CBA has lost less than the overall market despite the media scrutiny and reputational damage experienced during the Royal Commission. Investors in Australian bank shares are most worried about two potential issues:

- Businesses being hit so hard by the slowdown that they will be unable to make repayments on their loans and may default.

- Unemployment rates increasing and some customers being unable to make personal lending and mortgage repayments.

There are a number of other impacts on banks, but these are the most significant factors driving these significant share price drops.

Will Banks Be Ok?

It is important to remember that since the global financial crisis of 2008, regulators and banks have been working hard to make Banks safer and better placed for events such as the current pandemic. Specifically:

- More Capital – Australian banks hold ~2x more capital than pre-2008. Capital levels help absorb unexpected losses arising from events such as the one we are in.

- More Cash / Liquids – Since 2008, banks hold more High-Quality Liquid Assets (“HQLA”) which are assets that can easily be converted to cash. Having more cash allows banks to meet the demands of depositors if many of them decide to withdraw their money (“a bank run”).

- More Stable Funding – Banks raise deposits and wholesale funding and lend this on to their customers. Wholesale funding is debt raised by entering into contracts with institutions, ie issue bonds. Since 2008 regulators have introduced rules to ensure these contracts are longer dated which reduces the pressure on banks to replace funding during times of crisis. Unstable funding was a key factor which brought down Northern Rock in the UK and Lehman Brothers.

APRA Relaxed Capital Regulation. Why and What Does This Mean?

Last Thursday, APRA temporarily relaxed their stance on Bank capital ratios. APRA has been working with Australian Banks to increase their common equity tier 1 (“CET1”) ratios above 10.5%, however they have temporarily relaxed this requirement. Banks will be allowed to fall below 10.5% as this pandemic is worked through.

Why has APRA done this? As pandemic lending losses are incurred, or as loans start to deteriorate, bank capital levels fall. If banks try to raise capital (ie issue new shares) during this time when their share prices are so low the outcome is both uncertain and will likely negatively impact existing shareholders.

APRA’s change means banks can focus on lending/supporting customers without worrying if they have enough capital to do so during the pandemic. If lending also stops during the pandemic it will make the financial impact significantly worse.

Summary

This is a devastating but interesting experience. Despite negative outlook, we think Australian banks are well placed to withstand a prolonged downturn. In our opinion, investors and employees should feel comfortable that the majors will survive this global pandemic, and we feel the Government would support banks should they need it.

We hope for the health and safety of all, and will be posting a few more of our thoughts over the coming days.