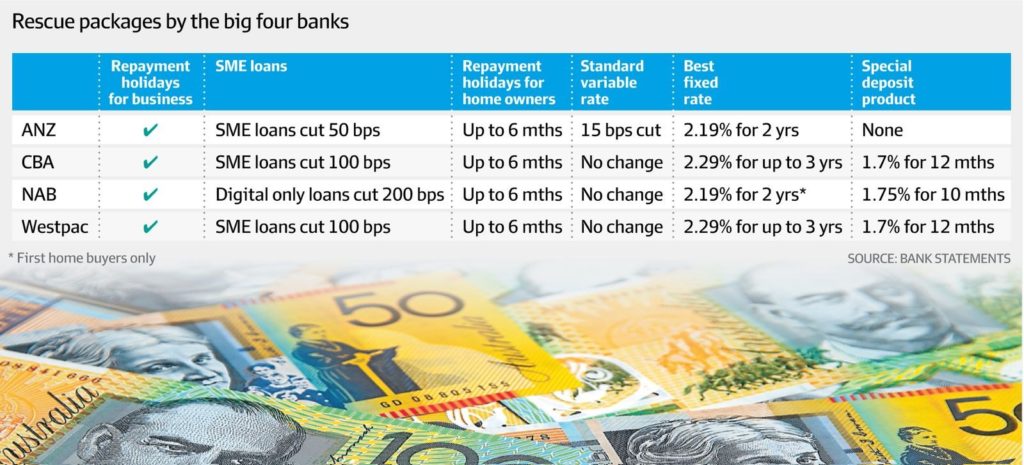

The RBA announced last Thursday that it would cut the official cash rate for the second time this month, down to just 0.25%. This is the lowest it has ever been in Australia. CBA was first to respond and the other majors have also followed closely with similar offers of support for customers.

Below is an overview of the rescue packages offered by the big four banks.

Why Have Banks Increased Deposit Rates When Cash Rates Have Fallen?

In these uncertain times with interest rates falling to almost zero, there are a few things to understand. When the RBA cut the official cash rate to 0.25% last Thursday demand for Government bonds fell dramatically. If demand for Government bonds has fallen, you can bet the demand for Australian Bank bonds has also fallen, especially given the unknown amount of losses that are coming. Banks are being quick to act to ensure they lock in as much term deposit funding as possible before things get worse. This will reduce the reliance on wholesale investors to purchase their bonds. Without stable funding in place, banks don’t survive.

The rates wholesale investors will demand on Australian bank bonds are likely to be well above the ~1.70% many of them are now paying for term deposits. This move sees the Banks try to lock in the cheapest term funding available during these uncertain times.

Why Have Banks Reduced Lending Rates?

This is an obvious one, but let’s cover it anyway to be clear. Reducing rates on loans for the customers which are most likely to default helps to ease the congestion on the bank teams which deal with bad loans and also increase the chance of business customers surviving this financial slowdown. If a business defaults on its loan the chances of the bank recovering any money is very low during times like this, however if they can help the customer to survive this pandemic downturn, they stand to not only have gained a loyal customer but also one which is more profitable (than a bankrupt customer). It’s a win-win for everyone or rather avoiding a lose-lose situation.

Why Are Banks Offering Cheap Fixed Mortgages Rather Than Cutting SVR?

Last Thursday the RBA announced it would provide a 90bn funding facility to the banks to allow them to lend during this uncertain time. This facility is very cheap at a fixed 0.25%. This is the funding that will be used to lend to customers at fixed rates of ~2.19%. A very healthy 1.95% margin. Cutting SVR is very expensive for Banks given the recent increase on term deposit rates and increases coming on wholesale funding spreads but ANZ has done this anyway but has not increased term deposit rates.

During this time we want banks to be able to make some extra little pockets of profit, we need them to do so in order to have a better chance of surviving the losses that are coming. Overall bank profits are going to significantly decline – dividends will decline too.

What To Make Of Repayment Holidays

This is a dangerous game but the lesser of two evils. During repayment holidays interest on loans will continue to accrue, so basically businesses are borrowing even more from the banks to pay their interest. That means at the end of the holiday, their debts will be larger than they are now so we are all hoping things have recovered enough for them to service those higher debt levels. These holidays allow the banks some more thinking time to adequately and appropriately deal with the situation.

Hello Neobanks? Are You Still There?

The new digital banks which have emerged over the past 12 months seem to still be determining how best to support their customers and we await their announcements on how they will continue to be customer-focused during these interesting times. We could not yet find anything on their websites that addresses the pandemic concern or offering financial support to customers. These are the times when your customers need you most.